Written by Craig Leigh, Mortgage Adviser, The Mortgage Broker

Book a free landlord review with Craig, here.

Key takeaways: what to remember if you’re buying with a small deposit

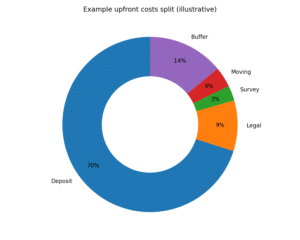

- Low deposit doesn’t mean low cost. Plan for legal fees, surveys, moving costs and a safety buffer, not just the deposit.

- 5% deposit is still the “core” low-deposit market. It often offers more lender choice and flexibility than ultra-low deposit deals.

- Ultra-low deposit deals can work, but criteria gets tighter. Expect stricter property rules and affordability checks at 97-99% LTV.

- Property type matters more than people expect. Flats and new builds can be harder at higher LTVs, so check eligibility early.

- Family help isn’t one thing. Gifted deposits and family-assisted products work differently, and the paperwork matters.

- The best move is comparison, not guesswork. The “best” option depends on your deposit size, income, property type and how much breathing room you’ll have after completion.

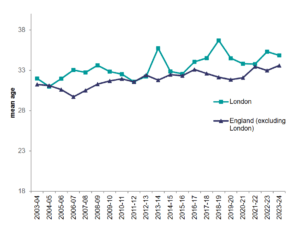

Mean age of first time buyers, London and the rest of England, 2003-04 to 2023-24

Source- Ministry of Housing, Communities & Local Government

The average first-time buyer age is now 34 in England and 35 in London (based on the latest English Housing Survey).

Saving for a deposit is still one of the biggest barriers to homeownership, especially for buyers who can afford the monthly payments, but can’t build a deposit quickly while rents and living costs stay high.

The good news is that lenders are starting to respond with more low-deposit solutions. The key is understanding which route fits your situation (and which ones come with strings attached).

The shift everyone’s talking about: Santander’s 2% deposit mortgage

Santander has launched a first-time buyer mortgage that can go up to 98% loan-to-value (LTV), effectively a 2% deposit, with a minimum deposit of £10,000 and a £500,000 cap.

It’s also been widely reported that it comes with strict property rules (notably excluding flats and new builds).

Why this matters (without the hype)

A mainstream bank moving beyond 95% LTV is a meaningful sign that the market is becoming more competitive for buyers with smaller deposits, but ultra-low deposit deals are never “no-strings”.

As our adviser Craig Leigh put it:

A move like this from Santander shows the market is shifting in a constructive direction, and a 98% loan-to-value deal can help buyers who are mortgage-ready from an affordability point of view, but are being blocked by the deposit hurdle…

The key, however, is context… ultra-low deposit deals can come with tighter criteria and pricing that reflects the higher risk… so it is imperative to get advice and compare all the options.

First, the numbers: what “2% vs 5%” really looks like

A tiny deposit can feel transformational, but the monthly payment and overall risk picture matter just as much.

Example: £500,000 purchase

2% deposit (minimum £10,000): £10,000 deposit, £490,000 mortgage (98% LTV)

5% deposit: £25,000 deposit, £475,000 mortgage (95% LTV)

At a 5.19% interest rate over 30 years, a £490,000 repayment mortgage would be around £2,688 per month (illustrative).

Deposit needed at 2%, 5% and 10% (by property price)

Use this table as a simple “at a glance” reference.

| Property price | 2% deposit* | 5% deposit | 10% deposit |

| £200,000 | £10,000* | £10,000 | £20,000 |

| £300,000 | £10,000* | £15,000 | £30,000 |

| £500,000 | £10,000* | £25,000 | £50,000 |

*Where a product has a minimum £10,000 deposit, £10,000 may be more than 2% on cheaper purchases.

Get StartedThe low-deposit routes that actually work

This is where online searches tend to converge: people aren’t looking for a list of banks, they’re trying to work out what’s realistic for them.

Route 1: 5% deposit mortgages (95% LTV)

For most first-time buyers, 95% mortgages (a 5% deposit) are still the “mainstream” low-deposit starting point. You usually get more lender choice here than at ultra-high LTVs, and pricing can be more competitive than the very top end of the market.

A good example is Nationwide, which actively offers 95% LTV mortgages aimed at buyers with smaller deposits.

Example: If you’re buying at £300,000 with a 5% deposit (£15,000), you’d typically need a £285,000 mortgage at 95% LTV.

Route 2: Ultra-low deposit mortgages (97–99% LTV)

Ultra-low deposit mortgages can be a lifeline when your affordability is strong, but savings are the thing holding you back. The trade-off is that lenders often manage the extra risk through tighter criteria, property-type restrictions, and fewer options if you need to switch lender later.

That’s why Santander’s “My First Mortgage” has grabbed attention, it’s reported as 98% LTV (2% deposit) with a minimum £10,000 deposit, but also with strict rules, including reported exclusions such as flats and new builds.

You’ll also see other high-LTV routes referenced in the market, including examples from building societies. The key point is the same: the smaller the deposit, the more important it is to check the criteria before you fall in love with a property.

Route 3: Family support (gifted deposits and family-assisted options)

Family support tends to fall into two buckets, and they work very differently.

Gifted deposits are the simplest: a family member gives money towards your deposit, and the lender will normally want the right paperwork and source-of-funds checks to confirm it’s a true gift (not a loan).

Family-assisted mortgages can help even when the buyer can’t build a traditional deposit quickly.

For example:

Lloyds “Lend a Hand” allows a family member to place 10% into a fixed savings account as security, which can support a buyer buying with no deposit in the traditional sense.

Halifax “Family Boost” uses a similar idea, a family member puts 10% into a linked savings account to strengthen the application.

Barclays “Family Springboard” also uses family savings as support, rather than requiring the buyer to provide the full deposit alone.

These can be brilliant solutions, but they’re not “free money”, someone else’s savings are being tied up, so everyone needs to be comfortable with the commitment and timescales.

Route 4: Affordable homeownership routes (Shared Ownership / First Homes)

Sometimes the best way to reduce the deposit pressure is to reduce how much you need to buy upfront.

Shared Ownership lets you buy a share of a home (often between 10% and 75%) and pay rent on the remaining share. Your deposit is usually based on the share you’re buying, which can make the upfront cost more achievable, but you’ll still need to budget for rent, service charges (where applicable) and future “staircasing” costs if you want to buy more later.

The First Homes scheme is a separate route that offers discounted homes for eligible buyers, with rules around eligibility and how the discount works when you sell.

Example: If you bought a 40% Shared Ownership share of a £300,000 property, your share would be £120,000, and your deposit would be calculated against that share (not the full £300,000).

Speak with an advisor today!

Request a call back

The catches people don’t budget for (and why low-deposit can feel harder than expected)

This is where many first-time buyers get caught out: you can scrape the deposit together, but completion costs and the first few months become stressful.

Costs buyers forget to keep back

- Solicitor fees, searches and moving costs

- Survey / valuation costs

- Initial repairs and first-month setup (appliances, furniture, small fixes)

- Buildings insurance (and other protection decisions)

- If buying a flat: service charges, ground rent, and any building works history

Negative equity risk

When you buy with a very small deposit, you have less “wiggle room” if property prices fall. That can matter later if you need to remortgage, move, or switch lenders.

Flats and new builds: why small-deposit rules can change fast

At higher LTVs, lenders can be more cautious with flats and new builds because of valuation risk, resale risk and (for flats) ongoing costs and building considerations. That’s why some ultra-low deposit deals come with property-type restrictions, Santander’s 98% deal has been reported with exclusions in this area, which reflects a wider trend at the top end of high-LTV lending.

The practical takeaway is simple: if you’re buying a flat or a new build with a small deposit, it’s worth checking lender criteria before you book surveys, pay legal fees or mentally commit to a property that might not fit the rules.

FAQs: Low-deposit mortgages in 2026

Sometimes, but ultra-low deposit deals usually come with tighter criteria (and sometimes property restrictions). Always check eligibility before assuming it applies to your purchase.

Often, yes. 95% mortgages typically have wider lender choice and can be more flexible. But 2% can help if deposit is the only barrier and you meet criteria.

Possible, but some lenders are stricter on flats at higher LTVs because of ongoing costs and resale/valuation factors. Check criteria early.

Sometimes, but new builds can attract tighter lending rules at higher LTVs. It’s worth checking lender appetite before you pay for surveys or legal work.

You’re more exposed to negative equity if prices fall, and your remortgage choices may be more limited if your LTV doesn’t improve.

Not always. Many buyers underestimate the early costs of homeownership. Keeping a buffer can prevent stress later.

In many cases, yes, but lenders usually require a gifted deposit letter and proof of where the funds came from (source-of-funds checks).

No. A gifted deposit is money given to you. Family-assisted options usually involve a family member’s savings/security supporting your application for a period.

Rate-shopping can be done sensibly. The key is avoiding lots of full applications without a plan. Start with a DIP/AIP approach and compare routes properly.

It depends on your affordability and the type of debt. Clearing some commitments can help affordability, but wiping out your savings buffer can be risky.

Down-valuations are more common than people think. If the valuation comes in low, you may need a bigger deposit, renegotiate, or switch route/lender.

Have clean bank statements, stable income evidence, a realistic budget (including bills/childcare), and check property eligibility early, especially for flats/new builds.

Call Us 0800 0320 316

Or Book a Free Mortgage Appointment

You can request a free, no obligation mortgage review with a qualified adviser now.

No mortgage offer, no broker fee.

Author: Craig Leigh, Mortgage Adviser