Written by Sam Kirtikar, CEO, The Mortgage Broker

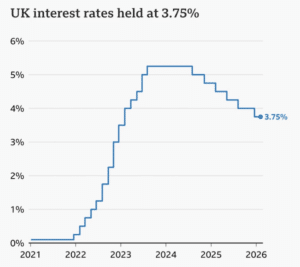

The Bank of England has held the base rate at 3.75% at today’s Monetary Policy Committee meeting.

Key takeaways: what to remember if you’re buying with a small deposit

- The Bank of England has held the base rate at 3.75%, so most borrowers won’t see an immediate change.

- Fixed-rate holders: no change to payments until your deal ends.

- Tracker-rate holders: usually stable payments (no base rate change = no automatic change).

- SVR / variable-rate holders: lenders aren’t forced to adjust rates, it’s still the lender’s choice.

- For new borrowers and remortgagers, mortgage pricing is driven more by swap markets and lender competition than the base rate headline.

- Today’s hold is unlikely to move rates dramatically on its own, but lenders can still reprice at any time.

- The bigger question is how long rates stay elevated and whether we see gradual cuts ahead (which supports affordability and confidence).

- If your deal ends in the next 3-6 months, planning early helps you avoid rolling onto an expensive reversion rate.

Get Started

The headline is simple: no change.

The reality is more useful: mortgage pricing doesn’t move purely on the day of an MPC decision, it moves on expectations, funding costs and how aggressively lenders want to compete.

This is why a hold can still lead to changes in the mortgage market over the coming days and weeks, even when the base rate itself hasn’t moved.

Source: Bank of England (5 Feb 2026)

What it means for existing mortgage holders

With the base rate staying at 3.75%, most existing mortgage holders won’t see an immediate change. If you’re on a fixed rate, you’re insulated from today’s decision and your monthly payment stays the same until your deal ends.

If you’re on a tracker mortgage, you’ll usually only see movement when Bank Rate changes (and because it hasn’t today, that typically means stability rather than relief). For those on a lender variable rate or SVR, lenders aren’t forced to adjust anything in response to a hold, so again, the likely outcome is “no immediate change”.

The real issue isn’t today’s decision in isolation. It’s how long rates stay elevated and how lenders price that risk into future deals. The market mood has been more positive since the December cut to 3.75%, and we’ll be watching closely for signs that the next stage in this downward path is supported by the data.

Fixed rates are insulated for now, trackers and variables should see stability rather than relief.

What it means for new borrowers

For buyers and remortgagers, today reinforces a key point: mortgage rates are influenced as much by market expectations and lender competition as they are by the base rate itself.

Because a hold was widely expected, this announcement alone is unlikely to shift pricing dramatically. But lenders can still reprice quickly when funding costs change or when competition heats up, which is why staying close to the market still matters.

Tip Box– A base rate hold doesn’t mean lenders won’t tweak deals, they can reprice at any time.

What it means for the broker market

A period of base rate stability is generally helpful. It allows advice to stay focused on suitability, affordability and planning rather than reacting to constant volatility.

We’re also seeing more borrowers having sensible conversations earlier about product end dates and refinancing plans, rather than leaving it to the last minute.

Speak with an advisor today!

Request a call back

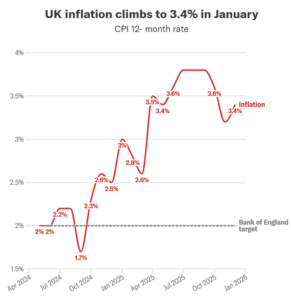

The inflation backdrop

Source: ONS

Inflation is one of the biggest factors behind how quickly interest rates can fall. Even when inflation eases, it doesn’t mean prices are dropping, it means they’re rising more slowly. If inflation remains above target, rate cuts tend to be cautious, which can mean mortgage pricing improves in steps rather than one big overnight drop.

The inflation angle:

The real impact on mortgage rates depends on whether inflation and swap rates keep moving in the right direction

Looking ahead: what a further cut could mean

If we do see another cut later in the spring, the first people to feel it are usually tracker borrowers. Fixed-rate customers typically only benefit when they refinance, but cuts can still lift confidence and affordability, which supports the wider market.

For new buyers, a cut is positive, but it’s often more of a confidence boost than an overnight transformation. Lenders often price expected cuts in advance, so the real impact depends on what happens between now and the next decision.

Call Us 0800 0320 316

Or Book a Free Mortgage Appointment

You can request a free, no obligation mortgage review with a qualified adviser now.

No mortgage offer, no broker fee.

Author: Sam Kirtikar, CEO