Written by Jodi Spreadbury, Senior Mortgage Broker, The Mortgage Broker.

Book a Free Appointment with Jodi, Here

Introduction

Remortgaging simply means switching your existing mortgage to a new deal, either with your current lender or a new one. Many homeowners look to remortgage when interest rates improve, when they want to secure a more stable monthly payment, or when they want to release equity for home improvements or personal plans.

But the big question remains: how much does it cost to remortgage?

If you’re considering your options, understanding the full remortgage costs involved is essential to avoid surprises and ensure you make the most financially sound decision. Let’s break it down.

Free Mortgage Review

1. What Is Remortgaging and Why Do It?

Current Mortgage

↓

Review Your Options

↓

New Deal Opportunities:

- Better interest rate

- Release Capital

- Debt consolidation

- More stable payments

↓

Improved Financial Position

(If suitable for your circumstances)

Remortgaging is the process of moving from your current mortgage deal to a new one. Homeowners often do this to secure a better interest rate, release equity tied up in their property, or consolidate debts into one manageable monthly payment.While remortgaging can offer significant savings over time, the remortgage cost can vary depending on the lender, your current mortgage terms and whether early repayment charges apply. Understanding this before making a decision is crucial.

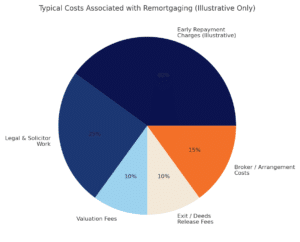

2. Typical Costs Associated with Remortgaging

When asking how much does it cost to remortgage, it helps to break the figures down. Below are the most common remortgage costs UK homeowners encounter.

a) Valuation Fees

A valuation fee covers the assessment of your property’s current value, helping the lender confirm how much they are prepared to lend. This cost can vary based on your property type and lender policy.

The good news? Many lenders now offer free valuations as part of their remortgage package, which can significantly reduce the overall remortgage cost. This is also helpful if you’re wondering how do I value my house for remortgage, as the lender will handle this directly.

b) Legal Fees

Legal work is required to move your mortgage from one lender to another. This includes verifying property ownership, arranging title transfers and managing completion.

Some lenders provide free legal work on remortgage deals, but where this isn’t included, typical solicitor remortgage cost ranges from £300 to £1000. Always ensure your solicitor is experienced in conveyancing to avoid delays particularly if your case is more complex.

This is often referred to as remortgage conveyancing cost or remortgage solicitors’ costs.

***There will be additional costs if you are looking to add or remove someone else from the mortgage and deeds

c) Early Repayment Charges (ERCs)

ERCs are one of the most significant factors affecting how much will my remortgage cost. These charges apply if you leave your current deal before the end of your fixed or discounted term.

ERCs are usually a percentage of your outstanding balance typically between 1% and 5%. For example:

Mortgage balance: £200,000

ERC at 3% = £6,000

In many cases, ERCs can offset any savings from a lower interest rate. This is one of the biggest considerations when assessing does it cost to remortgage early.

d) Exit Fees / Deeds Release Fees

When you leave your current lender, you may be charged a mortgage exit fee or deeds release fee. These costs are often overlooked but still apply in most cases.

Typical charges range from £50 to £300 depending on the lender. While small compared to other fees, they should still be factored into your total remortgage cost.

e) Broker Fees

A mortgage broker will compare rates across the market to find the right deal for your circumstances. Some brokers charge upfront fees, while others do not. At The Mortgage Broker, you only pay an application fee averaging £395, and only if you choose to proceed and your mortgage goes ahead. If no mortgage is secured, no fee is payable.

This ensures you receive expert guidance without adding significantly to your overall remortgage costs.

3. How Much Does It Cost to Remortgage on Average?

When combining valuation fees, legal fees, exit fees and any applicable ERCs, the average remortgage cost in the UK typically falls between £300 and £1,500 excluding ERCs.

Your final figure will depend on your lender, whether free legal and valuation services are included, and if early repayment charges apply. For many homeowners, even with fees, the long-term savings from securing a better rate outweigh the initial outlay.

This is why reviewing your mortgage regularly is always financially beneficial.

Read our article HERE about how a remortgage saved a client £126000 over the life of their mortgage

4. How to Minimise Your Remortgaging Costs

To reduce the cost of remortgaging:

- Choose deals that include free valuation and legal fees.

- Avoid ERCs by remortgaging at the end of your fixed deal.

- Review your mortgage annually to ensure you never slip onto a higher standard variable rate.

5. Is Remortgaging Worth the Cost?

For many homeowners, yes, especially if moving to a significantly lower rate. The key is understanding your full remortgage costs and comparing them with the savings a new deal could offer. Personalised advice is essential here.

Case Study-

A single fixed-rate remortgage replaced multiple high-interest debts, reduced the client’s payments by over £1,200 per month, and provided predictable, long-term affordability!

| Before Remortgage | Details |

|---|---|

| Mortgage | £322,000 @ 7.24% (21 yrs) — £2,490 pm |

| Secured Loan | £50,000 @ 11.99% (21 yrs) — £568 pm |

| Unsecured Debts | £7,721 — £502 pm |

| Total Monthly Payment | £3,560 |

| Property Value | £480,000 |

| Overall Balance | £379,721 |

| LTV | 78% |

| After Remortgage | Details |

|---|---|

| New Mortgage | £379,000 @ 4.30% fixed (5 yrs, 21 yrs term) — £2,290 pm |

| LTV | 79% |

| Property Value | £480,000 |

| Monthly Saving | £1,270 |

Call Us 0800 0320 316

Or Book a Free Remortgage Appointment

Quick fire FAQs with Jodi Spreadbury, Senior Mortgage and Protection Broker

Not always. Some lenders offer free valuations and free legal work on remortgage products. However, you may still need to consider exit fees, potential early repayment charges, and any broker fees depending on your chosen service. At The Mortgage Broker, you only pay an average £395 application fee if your mortgage goes ahead.

The cheapest time is usually at the end of your fixed or discounted period, as this avoids early repayment charges. Many homeowners start reviewing options 3–6 months before their current rate ends, giving enough time to lock in a new deal without incurring extra fees.

Yes. Your property value affects your Loan-to-Value (LTV), which lenders use when offering rates. A lower LTV may open up access to better deals. Most remortgage products include a free valuation, meaning the lender will confirm your property value for you.

In many cases, yes. A broker compares the whole market — including lenders that don’t offer deals directly to consumers. This often results in finding a more suitable rate or product than going to your bank alone. With The Mortgage Broker, your average £395 fee only applies once a mortgage is successfully completed, meaning no mortgage, no fee.

Yes, if a more competitive rate or a new product structure suits your circumstances. Remortgaging can also help consolidate debts or move you away from a higher Standard Variable Rate (SVR). Lower monthly payments are common when homeowners switch from high-interest or multiple commitments into one organised, lower-rate mortgage.

Free Mortgage Review

You can request a free, no-obligation mortgage review with a qualified adviser now.

No mortgage offer, no broker fee.

Author: Jodi Spreadbury, Senior Mortgage and Protection Broker