Written by Harrison Andrews, Mortgage and Protection Advisor, Buy to Let Expert, The Mortgage Broker

Book a free appointment with Harrison, here.

At a glance:

- Renovating is common in Buy to Let, but not every upgrade improves returns.

- The biggest gains usually come from increasing usable space.

- Extra bedrooms and bathrooms tend to lift both rent and resale value.

- Larger structural projects can transform returns, but only if the numbers work.

- You can get Free, No Obligation Buy to Let Mortgage advice with The Mortgage Broker specialists.

What Is Buy to Let?

Buy to Let is exactly what it sounds like: purchasing a property with the intention of letting it out rather than living in it yourself.

The return comes from two streams. First, the monthly rental income. Second, any long-term growth in the property’s value, this is known as capital growth. Because the investment is driven by income, every decision such as renovation decisions, needs to be measured against financial return. Unlike changes that you would perhaps make to your own home, this should not be about personal taste but rather focused on yield, risk and long-term performance. Yield is the financial metric that measures the amount invested on the property (such as refurbishments), compared to the income generated over a specific period. This is shown as a percentage of its total cost or current market value.

Therefore, it is important to understand which improvements genuinely increase the value of your investment.

Buy to Let is An Investment First, and a Property Second

When you buy a home to live in it, the improvements are personal whereas when you buy a property to rent it out, improvements are a financial decision.

With Buy to Let focused on the two streams mentioned earlier: rental income and capital growth, every decision, from replacing a kitchen to building an extension, needs to earn its keep.

The question isn’t “Will this look better?”

It’s “Will this strengthen the return?”

And that’s where many landlords get caught out.

Across the rental market, improving properties has become part of staying competitive and Buy to Let Landlords have carried out some form of work in recent years.

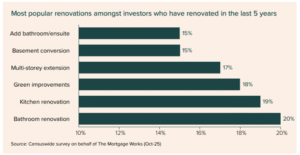

These can differ between straightforward upgrades like bathrooms and kitchens, through to investments in energy improvements or taken on more ambitious structural changes.

Important: For energy improvements, you can read the Energy Efficiency standard (EPC) guidance for landlords of domestic private rented property on on the HMRC website.

According to The Mortgage Works (mortgage lender) the chart shows bathrooms slightly ahead of kitchens, with green upgrades not far behind. Structural changes, while less common, are still significant.

But here’s where it gets really interesting, notable proportion say the experience didn’t quite deliver what they had hoped for. In many cases, it wasn’t the idea of improving the property that was flawed but crucially it was the gap between expected and actual return.

Renovation makes sense when it changes how the property performs in the market. It makes less sense when it simply refreshes what was already there.

The Cost Side of the Equation

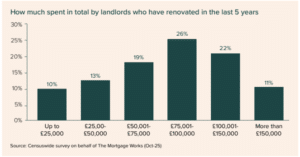

According to the same Censuswide survey, renovation budgets are not minor refreshes. The spend distribution graph shows landlords investing anywhere from under £25,000 to well beyond £100,000 depending on the scale of work.

What the spend breakdown really highlights is the scale.

For many landlords, this isn’t a few thousand pounds on fresh paint and new fittings, it’s a level of investment that could rival a deposit on another property. Once budgets move into five figures, the decision stops being about improvement and starts being about direction. Are you repositioning the property in the market? Are you future-proofing it? Or are you simply maintaining it? At this level, renovation becomes part of a wider portfolio strategy, not just a standalone project. However, of course, each case has to be taken on its own merits and in relation to the value of the property.

To help with strategic decisions, you can speak to a Buy to Let Mortgage Broker to understand rates and the total cost of borrowing money in order to make further investments. Either into your current property or as a deposit for another, and to maximise portfolio opportunities.

Book a Free Buy to Let AppointmentThe Changes That Tend to Add the Most Value

The data points to a clear pattern. The changes that truly shift a property’s standing in the market are those that add space or improve its overall function.

Adding a Bedroom

Increasing the number of bedrooms often shifts a property into a different tier of demand.

A two-bed home attracts one type of tenant. A three-bed home opens the door to families and sharers willing to pay more. That broader appeal tends to strengthen both rental income and resale value.

What makes this change powerful isn’t just the extra square footage, it’s the repositioning in the market. The property competes differently. That competitive shift is where value is created.

Adding a Second Bathroom

Bathrooms are a practical upgrade, but in rental property practicality is valuable.

In shared households especially, an additional bathroom reduces friction. That makes the home more desirable, which supports stronger rent and, in turn, stronger valuations. Interestingly, the premium attached to extra bathrooms in rental property appears more pronounced than in owner-occupied homes. For landlords, that makes it a functional upgrade with measurable impact.

Extensions and Loft Conversions

Larger structural projects go further. They don’t just improve a property, they reshape it.

Adding significant new space, particularly when it includes both a bedroom and bathroom, can lift the overall value of the property considerably. Rental income can rise sharply too, because the property effectively moves into a higher category.

These projects require careful planning. They also carry more risk, longer build times, higher upfront costs, and the possibility of void periods. But when done with a clear understanding of local market ceilings, they can materially improve both income and equity.

Energy Efficiency Improvements

Energy efficiency has moved from “nice to have” to “value driver”.

Homes with stronger EPC ratings are increasingly selling and letting better than similar properties in average bands, because running costs matter and buyers and tenants are more selective. Upgrades like loft or wall insulation, better glazing, heating controls or solar panels won’t always look dramatic, but they can boost demand, reduce void risk and help future-proof your investment as standards tighten.

For landlords, the upside isn’t just a short-term uplift, it’s protecting long-term value and flexibility.

Watch Out: Returns Can Be Eaten by Downtime

Renovation calculations shouldn’t stop at build costs.

If a property stands empty for several months during works, lost rent can quickly erode projected gains. Financing costs, contingency budgets and delays all need to be factored in before committing.

Many landlords who later questioned their renovation decisions weren’t criticising the improvement itself, they were reacting to the financial knock-on effects.

The lesson is simple: model the full picture before picking up a hammer.

A Practical Walk-Through: A Clear Decision Framework

Step 1: Identify what the property is missing

Start by looking at the property objectively. Is it smaller than comparable homes nearby? Does it lack a second bathroom where most similar rentals have one? Is there unused loft or side space that could be converted? The first step isn’t “what can I build?”, it’s “where does this property fall short in its local market?”

Step 2: Decide which type of improvement would change its position

Once you understand the gap, consider what would genuinely shift the property into a stronger bracket. In some areas, that might mean adding a bedroom. In others, improving layout or adding a bathroom may be more impactful. The goal is to choose a renovation that alters how the property competes, not just how it looks.

Step 3: Test local demand properly

Before committing, check how similar upgraded properties perform. Are larger homes achieving stronger rents? Are they let faster? Are properties with better layouts attracting broader tenant types? If the local evidence supports a step up in performance, the case becomes more convincing.

Step 4: Build the full financial picture

Now bring in costs. Include build quotes, contingency, professional fees and compliance requirements. Factor in potential void periods if tenants need to leave during works. The real investment is the total of all these elements, not just the contractor’s estimate.

Step 5: Consider long-term positioning

Finally, zoom out. Does this improvement strengthen the asset beyond immediate rent? Does it make the property more competitive long term? Would it appeal to a wider pool of buyers if you exited? Improvements that reposition the property sustainably tend to justify themselves over time.

Benefits of Getting Buy to Let Mortgage Advice

Getting Buy to Let mortgage advice can save you money, time, and nasty surprises, because landlord lending is full of moving parts: rental stress tests, tax position, limited company vs personal ownership, portfolio rules, EPC considerations, and lender quirks that can make a “good” rate completely unsuitable for you. A broker helps you line up the right product with the right lender first time, stress test affordability properly, and keep the application clean so you’re not losing weeks to rework.

Are you considering a limited company Buy to Let mortgage? Read more here around what you need to consider when it comes to Buy to Let mortgages.

Why speak to The Mortgage Broker?

- Specialist Buy to Let support for single properties, HMOs, multi-unit blocks and portfolio landlords.

- Access to 130+ lenders and 25,000+ products, including broker-only ranges.

- Faster, cleaner applications with clear document checklists and proactive case management.

- Straight, transparent advice from CeMAP-qualified advisers, with suitability and affordability front and centre.

- Strategy-led guidance on limited company vs personal ownership (and how lenders treat each), without the fluff.

- Future-proofing built in, including EPC considerations and lender criteria that can tighten over time.

- No mortgage offer = no fee, so you’re not paying for an outcome that doesn’t happen.

FAQs: Adding Value to a Buy to Let Property

No. Some improvements make a property look better, but not all change how it performs in the market. Projects that alter layout, space or functionality tend to have a more noticeable impact than surface-level updates.

If space allows, adding a bedroom often changes the property’s market position entirely. Simply upgrading an existing room may improve appeal, but it rarely shifts the rental bracket in the same way.

In many rental markets, yes. Shared households and families value practicality. A second bathroom can widen tenant appeal and reduce friction, which often supports stronger demand.

They can be, particularly if they create meaningful additional living space. The key is ensuring the local market supports larger properties and that the cost doesn’t exceed the potential uplift in rent and value.

Look at comparable listings. Are larger homes achieving higher rents? Do they let quickly? Speak to local letting agents and review recent rental data before committing.

That depends on the scale of work. Minor improvements may be manageable with tenants in place. Larger structural projects often require vacancy, which means factoring in lost rental income.

Most landlords allow a buffer for unexpected costs. Structural work in particular can uncover issues once walls or roofs are opened up. Building flexibility into the budget reduces pressure later.

They can improve marketability and future-proof the property, especially as efficiency standards tighten. In some markets, better-rated properties also achieve stronger pricing.

That depends on portfolio strategy and cash flow. A single large project may significantly reposition one asset, while smaller upgrades across multiple properties can spread risk and maintain steady income.

Starting with the idea of what they want to build rather than what the market demands. The strongest projects usually begin with local demand analysis and clear financial modelling.

Call Us 0800 0320 316

Or Book a Free Mortgage Appointment

You can request a free, no obligation mortgage review with a qualified adviser now.

No mortgage offer, no broker fee.

Author: Harrison Andrews, Mortgage and Protection Advisor, Buy to Let Expert